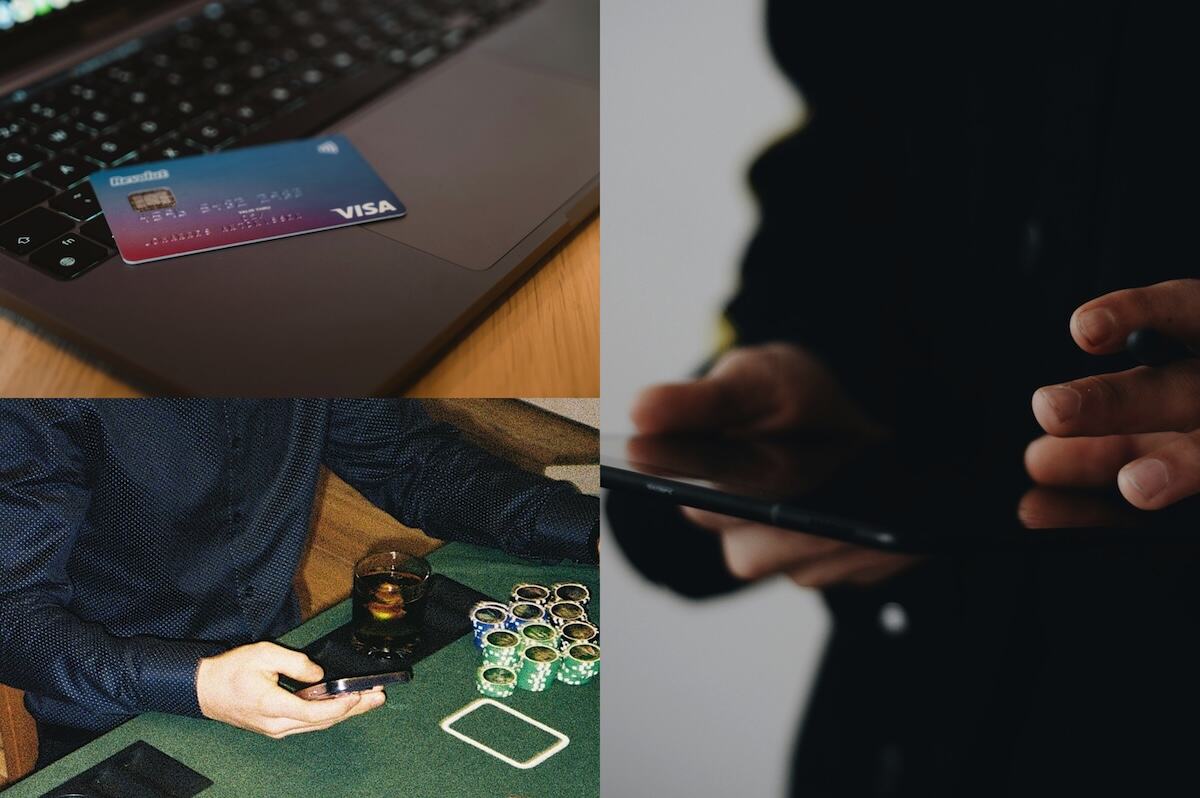

In the third fiscal quarter (Q3) of 2025, millions of casino gamers and sports bettors received the following from one of America’s leading gambling operators:

“We’re reaching out to let you know that, effective August 25th, DraftKings will no longer accept credit cards in the United States as a payment method for Sportsbook or Casino. The change is intended to help customers avoid cash advance fees and higher interest rates often associated with this payment method and otherwise improve the deposit experience. As a result, any stored credit cards will no longer be available for sportsbook or casino deposits after August 25th.” (DraftKings)

This, along with various other challenges presented in using credit cards to gamble within the contiguous United States of America, prompted thousands of individuals to enter “Can I use my credit card on gambling sites?” into Google search and ChatGBT. Given that you’re reading this, you may be among this group.

As with many things related to gambling in our nation, the answer is complicated. A number of banks and credit card issuers including American Express, Mastercard, and VISA have been known to (but not always) block transactions associated with gambling apps and websites. State regulations have also shown an interest in prohibiting the use of credit cards for gambling deposits. In Q2 of 2025, Illinois followed states such as Iowa, Tennessee and Massachusetts in banning credit cards to fund gaming accounts for online sports wagering.

The uncertainty and lack of clarity regarding the allowance of credit cards for online gambling has spurred the growth of marketing campaigns by operators (mostly unregulated) and gambling affiliate sites to educate individuals how to directly or indirectly use credit cards to fund gambling. As America’s leading problem gambling treatment provider and Responsible Gaming Award winner, Kindbridge is here to intervene.

While there are ways for healthy individuals to enjoy gambling in a responsible manner, things become far more complex with respect to financial health – which is intrinsically linked to mental health – when credit card use is involved. For this reason we encourage you to frame the question that brought you to this article with the following information in mind.

5 Critical Things to Consider Before Using Your Credit Card for Transactions on Gambling Sites

How Gambling Can Affect Your Credit Score

Technically, gambling activity does not show up on your credit report, nor does it directly impact your credit history. However, certain financial behaviors associated with gambling can compromise your ability to fulfill debt obligations, and may even alter creditor perception of your ability to fulfill debt obligations. While several factors impact your credit scores, credit card payment history is generally the most significant and is heavily influenced by how you manage your credit cards. Credit card balances are also a major factor through credit utilization, which is the amount of credit you use versus the total available credit. A high utilization rate can negatively impact your score, even if you make your minimum required payments on-schedule. When using your credit card to gamble (when permitted) you take on increased risk of harming your credit score, especially if you exhibit any vulnerabilities to problematic gambling behavior.

Click here to view more on how sports betting and casino gaming can affect your credit score.

History of Gambling with Credit Card Reflected When Applying for Other Loans

Given that the IRS requires you to report gambling winnings (more on this below) and that gambling with a credit card creates a digital paper-trail, a concerning form of financial behavior may get noticed when applying for a loan, be it to fund education, start a business, buy a home, or some other worthy endeavor. Remember, income history is something that lenders look at when determining whether or not they want to take a “risk” on you. They look at income tax assessments and bank receipts among other criteria. Increases in, or claimed losses against, annual income due to gambling may indicate on-paper that you are a frequent gambler, and this does not infer a confident investment for banks or private lenders. You may be considered to be a high-risk candidate for a business or home loan (etc.). View more on how gambling can affect loan applications.

IRS Needs to Know About It

While gambling sites will not permit withdrawals of winnings and account balance settlements directly to a players credit card, they generally allow them to be made to Third Party Settlement Organization (TPSO) platforms. PayPal and Venmo are among the most popular ones for gambling in the United States.

It’s important to note that the U.S. Internal Revenue Service (IRS) requires TPSOs such as PayPal and Venmo, to issue a Form 1099-K, which shows the total amount of payments settled through a TPSO in the calendar year. They are required to provide information to the IRS about customers who receive payments for the sale of goods and services through their platforms, gambling winnings included. As someone who is considering credit card transactions to gamble, you need to be aware of the fact that you too are required by the IRS to report gambling winnings as income. Further, Americans abiding by tax law who hope to claim gambling losses should know that after recent regulatory changes, they may only claim losses to offset income from gambling winnings. View the following articles to learn more:

All in all, gambling tax law adds yet another layer of complexity to the risk associated with using your credit card on casino gaming and sports betting sites.

Using Credit Cards on Unregulated Gambling Sites

There is one unequivocal truth to be found in your search for an answer to “Can I use my credit card on gambling sites?”, and that is you should never do so with unregulated offshore casinos and sportsbooks. They either accept credit card deposits or suggest that they can through various bait-and-switch methods.

Offshore Processing

Let’s first look at those who outright accept credit card deposits. In the introduction of this article, we indicated that many credit card companies have blocks in place to limit usage on gambling sites. If regulated gambling sites have limited capability to accept credit card deposits, how can unregulated operators do it? Offshore gambling operators have ways to get around this. Many use offshore processing companies to subvert credit card blocks by disguising transactions to appear as legitimate purchases. Some of these processing companies use fake online stores or other misleading billing practices to allow funds to be processed through networks that would otherwise block them, effectively bypassing financial controls and making it difficult for banks and credit card companies to identify gambling-related transactions. Not all offshore operators are aware of the tactics that certain processing companies use, and follow a “don’t ask, don’t tell” policy when solicited by the B2B service. Ask yourself, are you comfortable using your credit card with an offshore platform that may be using one of these processing companies? What recourse do you think you would have with them, if there were any concerning issues regarding false charges, et cetera?

Blockchain Bait-and-Switch

Secondly, we look at the bait-and-switch tactics used by unregulated operators who purport to accept credit cards. They will use landing pages on their websites to capture U.S. consumer search for gambling sites that accept credit cards, and then, once a visitor arrives at the landing page, they will be directed to guides that teach them how to use their credit cards to fund alternative payment platforms that have no issue with gambling transactions. While these options may include platforms that offer electronic versions of paper checks (i.e. eCheck) the primary form of alternative transactions that begin with a credit card occur on blockchains. You can use a credit card to start a cryptocurrency account through a cryptocurrency exchange. You cannot simply buy crypto (i.e. Bitcoin) with just a credit card; but you can create an account on an exchange and link your credit card. Many platforms like Kraken, Coinbase, and BitPay facilitate these purchases, though there are generally fees and interest charges associated with using a credit card for a volatile investment like crypto.

Don’t Use Your Credit Card on These Sites

In your search for information on casino gaming and sports betting sites that may accept credit cards for gambling, you may come across a select group of highly-popular unregulated offshore gambling sites. Do not make any transactions (especially credit card transactions) with any of them given the legality concern:

- BetOnline

- BetUS

- Bovada

- MyBookie

- MVP Bet

- TopBet

- Other (how to identify them)

Please reference the following articles for more on why you should never use your credit card to gamble with unregulated casinos and sportsbooks:

- Dangers of Online Gambling with Offshore Wagering Sites

- Illegal Online Gambling | Exploiting Vulnerable Americans

- Are Offshore Betting Sites Legal? What to Know Instead

Why Add Another Layer to Your Financial Stress?

At the 26th ICRG Conference on Gambling and Addiction, Kindbridge Research Institute’s Director of the Financial Stability and Responsible Gambling Initiative, Daniel Umfleet discussed the critical need to reframe financial stress as a public health metric. The discussion provided an overview of how doing so will help stakeholders better manage gambling’s impact on the wellness of America’s gambling population:

“Financial stress is more than a personal burden; it is a measurable, consequential factor in population health. Roughly 40% of Americans report moderate to high financial stress. Among young adults, 17% report high stress, and those individuals have over six-times greater odds of high psychological distress. Financial strain correlates with anxiety, depression, chronic illness, and mortality. Because of its prevalence and predictive value, financial stress should be tracked alongside depression, substance use, and other health indicators.” (Mind, Money, and Risk: Reframing Gambling as a Public Health Issue)

While you may not be a gambling regulator, operator, or financial services provider, YOU are a key stakeholder in the discussion about how to balance financial and mental wellbeing in the context of gambling behavior. As such, we ask you to recognize that approximately 46% of Americans have credit card debt of more than $7,300 (according to Debt.org). Moreover, we ask you to recognize that the following mental health statistics associated with debt:

Approximately 46% of people in problem debt also have a mental health problem

People experiencing mental health problems are 3.5 times more likely to be in problem debt than people without mental health problems

People in problem debt are 3 X as likely to exhibit suicidal ideation

72% of survey respondents report that their mental health problems had made their financial situation worse

Also reference the following statistics regarding gambling and debt:

20% of sports bettors are in or have been in debt from gambling

Average male problem gambler debt is between $55,000 and $90,000

Average female problem gambler debt is $15,000

Over 20% of compulsive gamblers file for bankruptcy

When using your credit card to gamble, you increase the risk of credit card debt, subsequently increase the risk of overall debt, and as the data shows, you increase the risk of compromised mental health.

If you gamble, doing so beyond your means (i.e. using credit to do it) adds another layer of financial stress to your life that you and your mental wellbeing can do without.

Do You Struggle with Financial Issues Due to Problem Gambling?

CALL +1 (877) 426-4258

OR