Gambling bankroll management is a term used to describe the practice of setting, organizing, and controlling the amount of money an individual allocates for ongoing gambling practices. It purports to approach gambling in a strategic and disciplined manner to mitigate risk, survive losing streaks, and make more calculated decisions. It’s promoted by operators, affiliates, and gambling influencers as a responsible gambling strategy for casino gaming, horse racing, and sports betting, although it can be applied to any form of wagering activity.

While gambling bankroll management varies by wagering activity and whomever suggests to have the “most effective” strategy, the general outline for casino gaming, horse racing, and sports betting are detailed below.

*As America’s leading problem gambling support provider, Kindbridge is providing an overview of gambling bankroll management to provide insight into how proponents market it as a responsible gambling practice. In reality, gambling bankroll management may set in motion a dangerous rationale for millions of Americans who are vulnerable to problematic gambling behavior, which we discuss in this article.

HOW GAMBLING BANKROLL MANAGEMENT WORKS

Set a Budget: Determined by how much one can afford to lose from their disposable income.

Divide by Session: A monthly budget is divided equally into a predetermined number of gambling sessions for the month. For example, if a casino player has a monthly $500 bankroll and plays four times per month, they would allocate $100 towards each session and not spend beyond the session budget. Meanwhile, if a sports bettor has a monthly $400 bankroll for the weekly (generally) NASCAR Cup Series schedule and bets four times per month/race, they would allocate $100 towards each session and not spend beyond the session budget.

Divide by Game: As an alternative or supplement to dividing by session (above) a casino player may instead or also assign a portion of their budget to different games, such as “x amount” for slots, “x amount” for blackjack, and “x amount” for roulette., et cetera. Meanwhile, a sports bettor may instead or also assign a portion of their budget to different leagues, such as “x amount” for NFL, “x amount” for NBA, and “x amount” for MLB games, et cetera.

Wager a Fixed Percentage: One’s gambling bankroll is broken down into units, typically about 1% to 5% of the total bankroll. Those following the strategy intend to wager units consistently, without ever wagering in larger amounts. This strategy may also involve placing the same flat wager amount every time.

Play Games with a Lower House Edge: The house edge is a given casino’s built-in advantage. Technically, games such as blackjack have a lower house edge when compared to roulette or slots as there is more strategy/skill involved for seasoned blackjack players.

Establish Win Limits: A player determines a profit target, that if reached, is immediately followed by a cash out of one’s winnings and departure (land based) or log-off (online) from the casino, race track, or sportsbook. This requires an individual to recognize that winning streaks may occur, and to not take the experience as a sign to bet beyond their budget in the hopes of leveraging a winning streak.

Establish Loss Limits: Conversely, a loss limit is also employed, where which one determines a maximum amount they are willing to lose, when if hit, they immediately cease playing. One must accept that losing streaks are inevitable, and to not break from the budget and unit betting plan to “chase loses” (where a gambler increases bets in an attempt to win back money they’ve already lost).

Again, proponents of gambling bankroll management suggest that it’s an effective responsible gambling strategy because it supposedly i) minimizes risk in that it protects a frequent gambler from losing all of their money during an inevitable losing streak, ii) reduces emotional betting by ensuring that a gambler adheres to a predefined plan and avoid impulsive decisions driven by anxiety after losses or false-confidence after wins, iii) creates a sustainable plan that encourages a participant to treat each wager like a component of long-term investing, rather than a single all-or-nothing bet, and iv) promotes discipline in that it establishes a structured approach to casino gaming, horse racing, and sports betting, fostering self-control and calculated decision-making.

On the surface, gambling bankroll management may be looked at as a sustainable responsible gambling strategy. However, for a notable segment of the population it can provide a false and dangerous sense of security. Clinically speaking, this faulty belief is known as a cognitive distortion, a phenomenon observed in gamblers who experience the illusion of control over a given outcome. Learn more about cognitive distortions in gambling here.

Below is a breakdown of how the four suggested risk-management benefits above may not apply to the 3-7% of the American population (millions of citizens) who are vulnerable to problem gambling, along with those who live with cooccurring mental health issues.

How Gambling Bankroll Management as a Responsible Strategy May Not Apply Those Who Struggle with Problem Gambling and Cooccurring Mental Health Issues

Cognitive Distortion 1: Minimizes Risk

The suggestion that gambling bankroll management protects a frequent gambler from losing all of their money during an inevitable losing streak may make sense for someone who can stop themselves after hitting their loss limit. But this is not so easy for someone who already shows tendencies to problematic gambling behavior. As per this feature on the Psychology of Gambling, problem gamblers (no matter the severity) have difficulty controlling urges. They are more likely to chase losses by betting beyond their self-imposed limit in an attempt to win back money they’ve already lost.

Cognitive Distortion 2: Reduces Emotional Betting

The suggestion that gambling bankroll management protects a frequent gambler by ensuring that they adhere to a predefined plan and avoid impulsive decisions driven by anxiety after losses or false-confidence after wins, means little to someone who is struggles with problem gambling. Emotional regulation is one of the first things to go out of the window for a problem gambler, especially if they have one of many mental health issues that cooccur with problem gambling (click to view them here).

Consider this, if gambling bankroll management cannot apply to 3-7% of the American population who struggle with problem gambling, how does the supposed advantage of emotional regulation factor into populations (be they “diagnosed” as problem gamblers or otherwise) with larger percentages of mental health instances where emotional regulation is compromised? Will the 5% of American adults with attention deficit hyperactivity disorder (ADHD), much less the 19% of the U.S. adults who suffer from an anxiety disorder, be able to refrain from betting based on emotion?

Cognitive Distortion 3: Creates a Sustainable Plan

The suggestion that gambling bankroll management creates a sustainable plan in that it encourages a participant to treat each wager like a component of long-term investing, rather than a single all-or-nothing bet, also comes into question when one looks at the data. Can gambling be a long-term investment strategy?

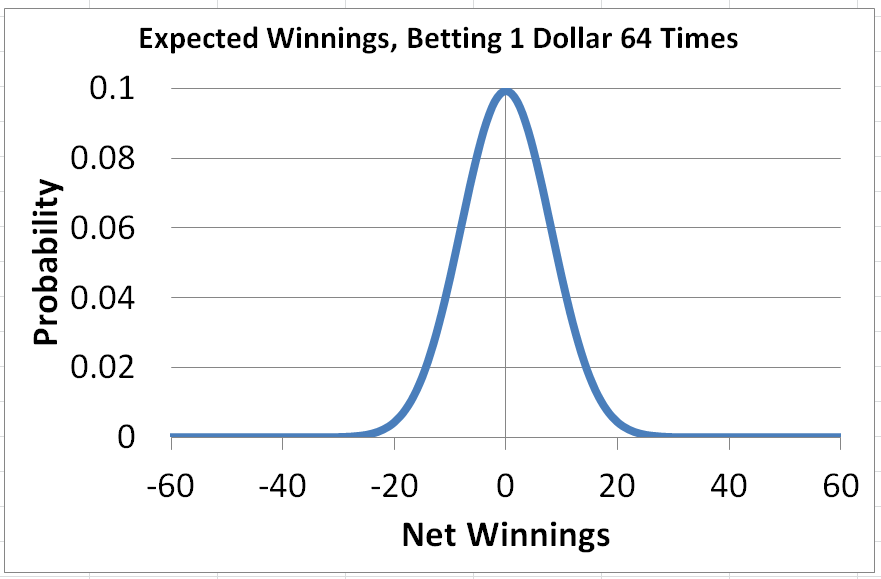

In a recent feature titled, Sports Betting as a Side Hustle is a Dangerous Myth, it was unveiled that only 13.5% of longterm bettors make it out with a profit, and that number typically declines the longer they play. The latter has been proven by the Gambler’s Ruin Formula, which when tested uses the exact same wager (as per bankroll management strategy) over an extended period to show what occurs overtime:

Cognitive Distortion 4: Enhances Discipline

The argument that gambling bankroll management promotes discipline in that it establishes a structured approach to gambling and fosters self-control and calculated decision-making, is also weak when it comes to those who are vulnerable to problem gambling and cooccurring issues where self-control and decision making are innately compromised. A problem gambler already struggles with self-control and decision making. But what about when ADHD is evident? ADHD impacts self-control because brain differences make it harder for individuals to “hit the brakes” and consider consequences before acting, a challenge often linked to the brain’s underdeveloped cognitive control system compared to its heightened reward system. Research also confirms that depression is strongly linked to reduced self-control, with low self-control potentially leading to or worsening depressive symptoms. The list of cooccurring mental and behavioral health issues that render gambling bankroll management fruitless is as long as the odds of making online slots a sustainable career.

To reiterate, a gambling bankroll management strategy can work for some. But for millions of Americans who are vulnerable to or already exhibit problematic gambling behavior and cooccurring mental health issues it presents a dangerous way of thinking.

Concerned About Your Relationship with Gambling?

CALL +1 (877) 426-4258

OR